Is Block (SQ) a Buy After Hindenburg’s Short Report?

Notorious short-seller Hindenburg Research was at it again this week. This time, the target was Jack Dorsey-owned fintech company, Block (NYSE: SQ). Just months after Hindenburg attacked the Indian conglomerate, the Adani Group, the short-seller was back with another hit piece against a popular Wall Street name. As always, Hindenburg’s report comes with a lot of allegations as well as an admission that they have a short position against Block’s stock.

Over the years, Hindenburg’s reports have sent stocks down an average of 15% the day they are released. Block was no exception on Thursday, as shares were down more than 20% in the morning. The stock closed the week down by more than 17%. In the past, Hindenburg has targeted companies like DraftKings (NASDAQ: DKNG), Lordstown Motors (NASDAQ: RIDE), and Nikola (NASDAQ: NKLA).

So is Block a buy after the latest short attack by Hindenburg? Wall Street seemed to shrug this report off a little bit more than others. Block has lost a lot of the lustre that it had during the pandemic but has shown some significant growth over the past few quarters. Was the report warranted and accurate? Or was Hindenburg once again just feeding its short position? Let’s take a deeper look.

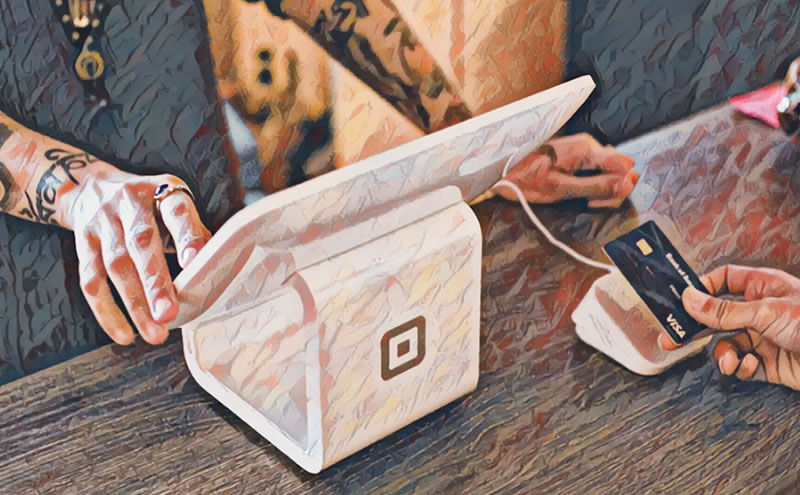

Hindenburg Alleges the Cash App is used by Criminals

Much of the allegations in the report revolved around the flagship Cash App platform. Hindenburg alleged that the app is rife with criminal activity and fraudulent accounts. Hindenburg revealed that it had interviewed former Block employees that said that at least 40% of the accounts on the Cash App are fake. The short seller followed this up by ordering a Cash Card under the name Donald J Trump, which was delivered without any questions from Block.

Hindenburg had multiple other allegations including fraudulent acceptance of COVID subsidies via the Cash App as well as Block funnelling some of its revenue through a small bank. So what does this all mean for Block? The company shot back and stated it would be working with the SEC to pursue legal action against Hindenburg. The company’s stock has already tanked, in the favour of Hindenburg’s short positions.

Block Stock is Interesting at These Prices

Are the allegations concerning? Absolutely. But take a step back and think about how many Visa (NYSE: V) or Mastercard (NYSE: MA) credit cards are used fraudulently. When you think about it, the allegations might not be as bad as they appear at first glance. Sure, if Block is hiding or misreporting revenues that is serious, and if most of the accounts on the Cash App are fraudulent, then the company has been misleading about its numbers.

I wouldn’t put Block in the same conversation as Lordstown or Nikola. Personally, I think this short report will fade faster than the others. Block has a true vision to change the financial system for the better and right now, the financial system truly needs all of the help it can get. If you have been eyeing Block’s stock, I would consider buying shares of Block at these levels for the long term.

Rate this article