In a landscape driven by ceaseless innovation and dogged competition, Nvidia stands out like a giant whose strides determine the fate of an industry. A recent review of their earnings report reveals a storyline straight out of a Silicon Valley fairytale: the transition from being primarily a gaming company just a decade ago to now, where data center business accounts for a whopping 76% of their revenues. Such is the transformative journey of Nvidia (NASDAQ: NVDA).

Sequel or Revolution? The Parabolic Rise of Nvidia

When discussing Nvidia's earnings, it's impossible to ignore the magnitude of its growth. This is not the gradual, steady ascent that Wall Street often applauds. No, it's explosive – something that many would argue is unsustainable. Often, in the financial world, skeptics invoke the "law of large numbers" to caution against expecting similar growth trajectories in the future, especially for giants of Nvidia's stature. Yet, against these cautionary tales, Nvidia stands defiant, with a future outlook that appears to be as robust as ever.

The company's trajectory is reminiscent of "The Godfather Two"; a sequel that matches, if not surpasses, the original. Such transformations are not only rare but also make market watchers nervous. When expectations run as high as they have for Nvidia, many investors grow uneasy with such parabolic growth, accustomed as they are to the steady predictability of linear progress.

Competition in the Silicon Arena

The semiconductor industry is no stranger to fierce competition. AMD (NASDAQ: AMD), under the stellar leadership of Lisa Su, has made commendable inroads in a market that once seemed impenetrable. Although they entered the data center GPU market early and have shown promising traction against giants like Intel, the real test is their confrontation with Nvidia. Despite the optimistic expectations, the prevailing sentiment appears to be that while AMD may gain some market share, toppling Nvidia would be a difficult task.

Nvidia's product range, which bridges the gap between training and networking in the ethernet domain, combined with their impressive results, suggests an uphill battle for competitors like AMD. The question isn't whether Nvidia is unparalleled - they clearly are - but whether they represent the sole titan in this technological race. The presence of other players and the continuous evolution of technology will always pose challenges, even to giants like Nvidia.

Nvidia's Ace Cards: Products and Vision

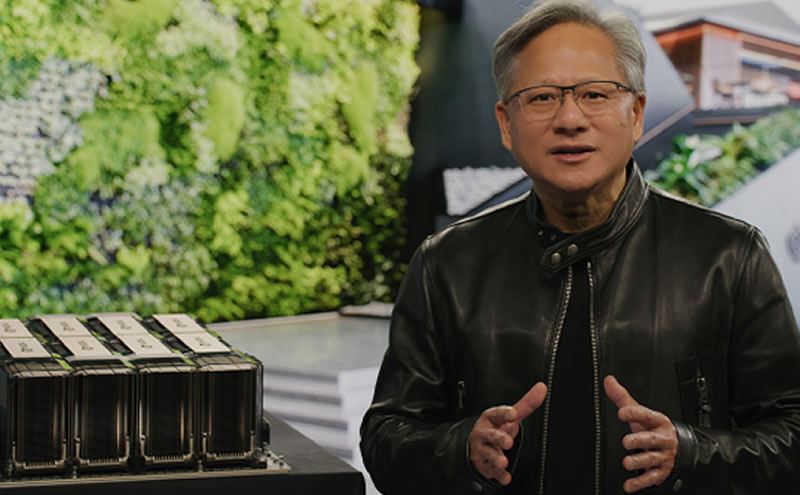

The key to Nvidia's dominance is a plethora of innovative products. From the HGX, which is still in its infancy, to the promising Ethernet product spectrum, they are setting the standards in the industry. Add software into this mix, and the company's roadmap appears not only aggressive but also visionary. While some may argue about which of Nvidia's products is the standout star, it's evident that the company isn't merely playing the game - they're shaping its future.

However, it's not just about products. Nvidia's bold strategy also revolves around capital allocation. Their commitment to R&D is clear, but it's the audacious decision to buy back shares, to the tune of an additional $25 billion, which signals their confidence in their trajectory. For a $1.1 trillion market cap company, this isn't just a statement—it's a testament to their belief in their growth story.

Geopolitics: The Cloud on the Horizon?

Yet, even giants have their Achilles' heel. For Nvidia, geopolitics, especially the China-U.S. dynamics, poses significant concerns. The U.S. technology export controls have the potential to disrupt the semiconductor sector, spelling a significant "loss of opportunity" for companies like Nvidia. Navigating this tricky landscape requires not just technological expertise but also geopolitical acumen.

Conclusion

Nvidia's story is emblematic of the tech world's audacity, agility, and foresight. Their transformation from a gaming-centric entity to a data-center powerhouse is a testament to their vision. However, as with all great narratives, challenges persist. For Nvidia, the challenges aren't just technological but also geopolitical. Yet, given their track record, betting against them would be a risky endeavor. In the semiconductor universe, Nvidia shines bright, casting a long shadow that many aspire to escape but few can.

Rate this article