Fiverr (NYSE:FVRR) is a stock that seemingly came out of nowhere in 2020, and unless you are a freelance worker you may not have heard of the company before its meteoric rise. The Israel-based company is the leading provider of freelance work and is the premier platform for the gig economy. As the COVID-19 pandemic continues to force people to work from their homes, many resourceful people are finding that freelancing in the time they are saving from commuting back and forth to the office, is a great way to make extra income.

So how well has Fiverr’s stock performed this year? On January 1st, before the coronavirus pandemic really took hold, shares were trading at just over $24 per share. Currently, the stock is trading just under $160 per share, which represents a near 560% increase over the past ten months. The impressive thing is that the stock has already undergone a correction as shares hit an all-time high of $184.99, so the current levels represent a 15% pullback from its recent highs. The median analyst price target for the stock is $172.25 which does allow for some upside from its current price.

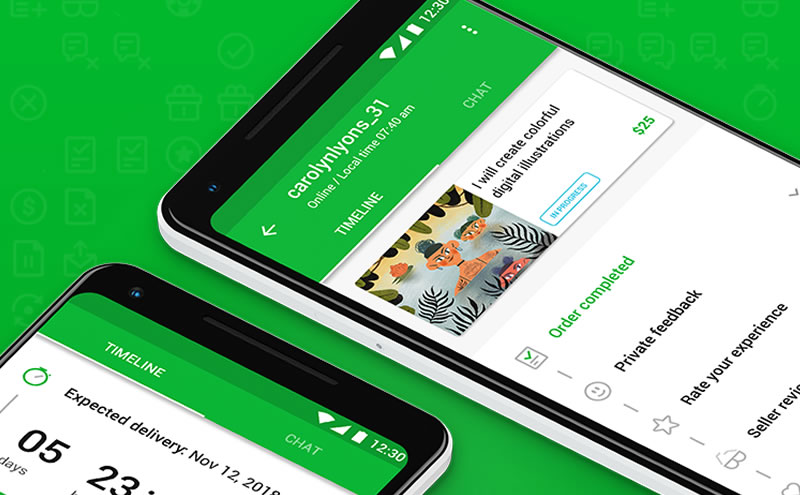

But has Fiverr gone too high too fast? The company recently released its third quarter earnings and the results blew Wall Street’s expectations. An astounding 88% increase in revenues year-over-year and the amount of buyers increased nearly 40% with the average gig purchased rising to $195. What does that mean for Fiverr? Well first, the company takes 20% off of each sale made across the entire site. That is an incredible recurring revenue stream, especially as the platform grows in popularity. The more buyers there are, the more sellers the site will attract, and here-in lies the beauty of the gig economy. Before you know it you have created an organic ecosystem that creates its own equilibrium of supply and demand, while the host, Fiverr, takes a nice cut as a finder’s fee.

In 2019, an estimated $1 trillion was made doing freelance work around the world and by as early as 2030, experts expect 80% of the global workforce to be freelancers that work in the gig economy. Those are staggering numbers. In a new normal where the office may be a thing of the past, more people are going to take the opportunity to use their time to augment their income. Does Fiverr have any competition? Sure. UpWork (NASDAQ:UPWK) is probably the most well known one, but Fiverr has surpassed UpWork in growth, conversion, and customer retention. There are hundreds of other freelance sites but none of them can hold a candle to Fiverr in terms of buyer and seller availability, as well as total job opportunity. Fiverr’s stock is flying right now, and for some it may already be too expensive. But remember, we cannot let a stock price dictate a company’s valuation. All signs point to Fiverr continuing to be the global leader in freelance services and should be the industry leader for the gig economy moving forward.

Rate this article