In a world of media giants and shifting landscapes, Disney's (NYSE: DIS) strategic maneuvering presents an enthralling tale. As Disney grapples with significant issues from real estate relocation to political tussles, a few key topics stand out in this multifaceted narrative.

The billion-dollar question lingering over Disney concerns a substantial real estate relocation. Now, one could see this as a deft move by Disney to put political pressure on Governor DeSantis. However, that narrative may oversimplify the complex dynamics at play. It's akin to saying a master chef is merely cutting onions when they're crafting a Michelin star-worthy dish.

You see, this is not about a political chess game; it's more about Disney's evolving business model. Let's not forget, Disney is a massive cruise ship navigating the stormy seas of financial and market pressures. The relocation could be a symptom of cost-cutting initiatives and efforts to streamline operations rather than political posturing.

Consider this: is it possible that the Florida project is just a part of a broader tapestry of economic strategies, like a single brushstroke on a vast canvas? It's clear that politics play a role in Disney's future, but to say it's a significant financial issue would be like attributing the beauty of the Mona Lisa to her enigmatic smile alone. The situation is more complex, and the impact on Disney's overall business health needs a more profound examination.

What about Hulu's role in this unfolding saga? It's not an understated subplot. Disney has expressed interest in acquiring Comcast's one-third share in Hulu - an investment that could require Disney to secure at least $9 billion more in its coffers. This move might feel like ordering an expensive main course at a fine-dining restaurant - it can be risky, but if done right, it could result in a memorable feast.

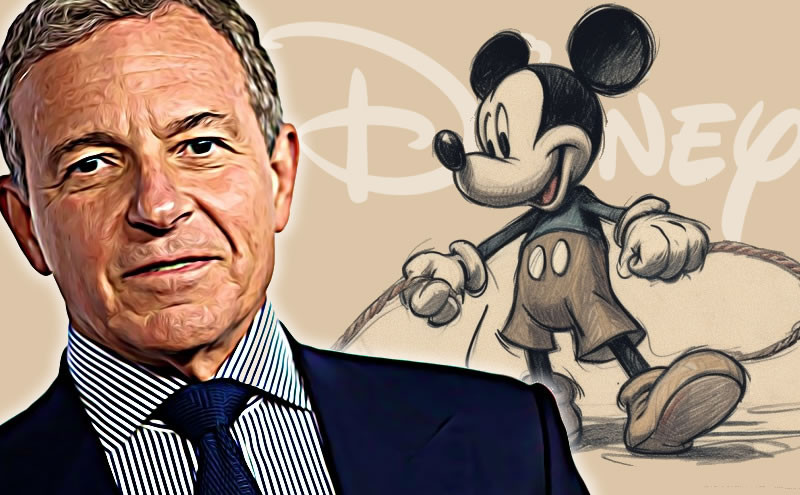

And then there's ESPN, Disney's wild card. The decision to take ESPN over the top, i.e., to offer it directly to consumers, is akin to taking a leap of faith. It could open up new revenue streams or be a financial belly flop. It's the kind of move that could either make Bob Iger look like a visionary or an over-ambitious risk-taker.

Speaking of Bob Iger, the man is walking a tightrope as if he's in a high-stakes circus performance. His performance in this delicate balancing act is as crucial as a maestro conducting a symphony orchestra.

On one hand, he needs to manage Disney's significant investments in Florida, including a $17 billion infusion into their parks and thousands of new hires over the next decade. On the other hand, he must navigate the turbulent waters of a weakening linear TV business, cord-cutting trends, and a delicate advertising market. His role resembles a seasoned sailor trying to guide his ship through a storm, all while plotting a course to calmer waters.

In the political arena, Governor Ron DeSantis looms large. If he runs for president, as predicted, his campaign could prolong Disney's political woes, much like a storm cloud that refuses to dissipate. It's a subplot that could add an extra layer of complexity to the Disney saga and might change the public's perception of the entertainment giant.

In conclusion, Disney is navigating a labyrinth of challenges, from the intertwining paths of business and politics to the mysterious corridors of market dynamics. How they manage this maze is still not clear and therefore Disney stays on the watchlist.

Rate this article