Summary:

Dollar-Cost Averaging (DCA) is a method investors use to profit from asset purchases without being affected by volatility.

Earnings are hitting milestones for AMD, and profitability has improved dramatically.

Buying more of AMD’s stock through DCA would ensure you can double your money in 5 years.

Lots of investors and traders think they can time the market. But losses make them abandon those newbie expectations. There is a lot of money in the market, but you need to have a plan to reap the benefits. One strategy that has always worked is dollar-cost averaging, or what some call "the constant dollar plan."

Dollar-cost averaging (DCA) involves making periodic purchases of an asset by dividing the total amount invested over those periods. The investments do not take note of the price of the asset but occur at regular intervals to reduce the effect of volatility on purchasing the asset.

While going through the fundamentals of Advanced Micro Devices, Inc (NASDAQ: AMD), it occurred to me that the stock was prime for DCA. Any savvy investors who do DCA on AMD would build many savings and wealth over time. Also, this would reduce the short-term volatility of the asset.

So why do I recommend DCA on AMD at the moment?

AMD Earnings Are Still Breaking Records

There are currently supply chain challenges in the tech industry right now. Any tech company that can post outstanding results despite these challenges is a great company to invest in. That is the case for AMD. After going through its Q1 2022 earnings report, we believe AMD is ripe for the taking.

Since 2020, AMD has been beating market estimates, and this time was no different. For Q1 2022, it earned $1.13 a share, significantly beating forecasts of 91 cents a share. Also, its sales rose 71% to $5.89 billion compared to the estimate of $5.01 billion. On a year-over-year basis, earnings grew 117%, which is impressive. This is the first time AMD is sailing past the $5 billion in sales, a milestone for the company.

Most of the strong sales earnings were due to its sales of server chips used by data centers. Cloud computing has shown itself to be the new frontier, and AMD provides chips to data centers for this purpose. Also, its acquisition of Xilinx, concluded this year, proved to be very significant to sales.

These earnings have placed AMD on a high pedestal in the chipmaking industry. It also has a high rating among growth stocks despite the industry's ongoing supply chain challenges.

AMD Shos No Signs Of Slowing Down

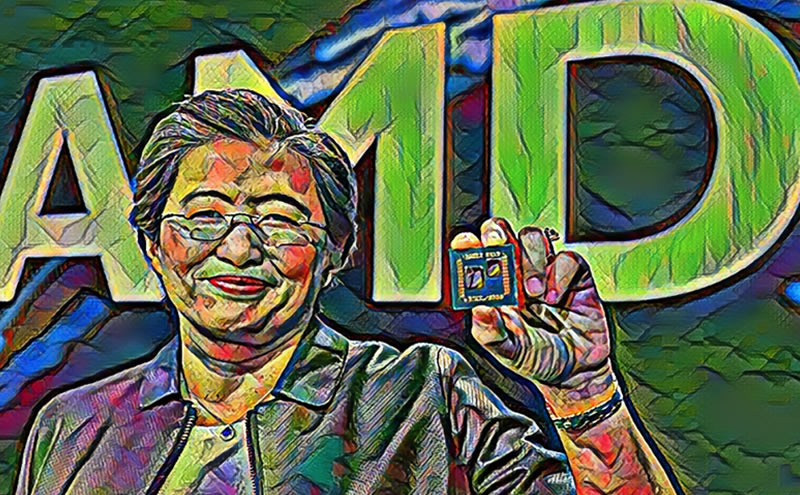

Despite the 71% jump in sales, market conditions show that in the next quarter, AMD can surpass that. From estimates, AMD will achieve a compounded annual growth of 30% over the next five years. By 2026, the earnings per share should stand at $10.36. Assuming you own AMD stock in the next five years, you would be doubling your money. This is not wishful thinking. Over the last seven years, since Dr. Lisa Su took over as CEO, the stock has risen by 4,500%. So the next five years would be one of anticipation.

The demand for AMD's products is solid. Sales of servers, embedded processors, game console technology, and semi-custom System On Chip (SoC) products were mainly behind half of the sales growth. This sector is projected to overtake the computing and graphics segment as the primary revenue driver for AMD.

Also, one reason for AMD's rising profile is its improving profitability. We see no reason why Dr. Lisa Su would not put more energy into further development of the company's profit margin. Through 2021, profit margins improved to nearly 20%, which would continue this year.

Despite the increasing rivalry between Intel (NASDAQ: INTC)and AMD (NASDAQ: AMD), AMD represents a compelling reason to buy more of the stock. Dollar-cost averaging would help acquire it at the lowest price, especially in this bear market.

AMD is currently trading at $94. It has, however, gone below that mark in the past few days. Each dip for AMD presents a perfect opportunity for a DCA, Make sure you make good use of that opportunity.

Rate this article