Advanced Micro Devices, Inc. (NASDAQ: AMD) introduced last month a groundbreaking innovation with the Mi 300X, a new chip that promises to radically accelerate advancements in artificial intelligence. The advancements in this chip could significantly boost AMD's stock value, given the considerable strides it embodies in the domain of large language models.

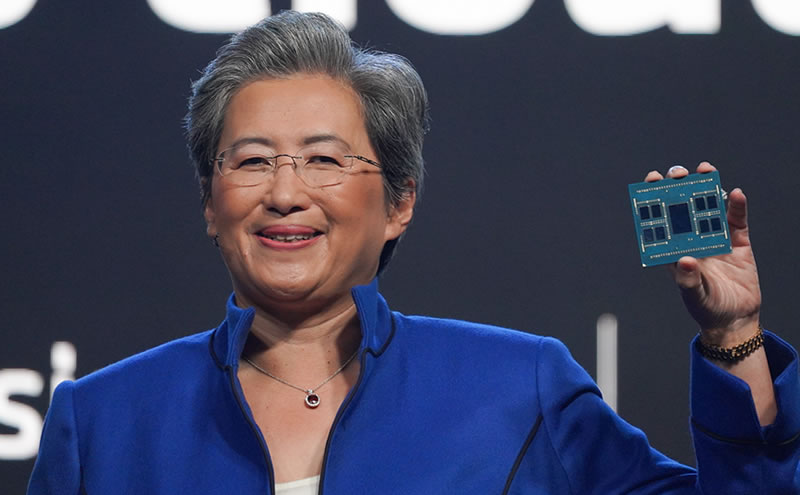

The Mi 300X is uniquely designed to handle generative AI's intense computational requirements. It pairs the cna3 with an industry-leading 192 gigabytes of hbm3 memory, an amount that enables impressive performance metrics. The chip delivers a staggering 5.2 terabytes per second of memory bandwidth, and its fabrication houses 153 billion transistors across 12 5-nanometer and 6-nanometer chiplets.

AMD's ambitious project leapfrogs the competition by offering 2.4 times more memory and 1.6 times more memory bandwidth. With this additional memory capacity, the Mi 300X presents a distinct advantage for large language models, allowing for larger models to run directly in memory. This efficiency significantly reduces the number of GPUs required, expediting performance for inference and minimizing the total cost of ownership.

However, while these impressive features give AMD's new chip an edge, challenges persist. As model sizes continue to grow, maintaining this level of efficiency and cost-effectiveness could become increasingly difficult, and scaling to meet demand may present its own hurdles. In addition, AMD will have to continue investing heavily in research and development to keep up with advances in the field of artificial intelligence and stay ahead of competitors.

On a brighter note, the implications for cloud and enterprise users are promising. The Mi 300X enables more inference jobs per GPU than before, facilitating large-scale deployment of the chip. This scale leads to lower total costs of ownership, making the technology more accessible to the broader ecosystem.

Further sweetening the deal for potential adopters, AMD also announced the Instinct Platform, an open infrastructure solution that houses eight Mi 300Xs. This platform, built to industry standard OCP specifications, allows customers to easily incorporate the powerful AI capabilities of the Mi 300X into their existing infrastructure, reducing time to market and overall development costs.

AMD's leadership appears confident about the future. The Mi 300X is currently being sampled to lead HPC and AI customers, with broader sampling expected in the third quarter of this year. Full production ramp-up is slated for the fourth quarter.

Despite the potential challenges, AMD's Mi 300X presents an exciting development for the world of AI and machine learning. As the technology matures and becomes more accessible, it could significantly boost AMD's market position and stock value, making it a promising investment for those looking to capitalize on the AI revolution.

Rate this article