2 Stocks to Ride the NVIDIA Hype Train

If you’re buying stocks at all-time highs, you better be patient. Even stocks like NVIDIA will pull back and re-test prior levels of support. At least they should, but who knows when that will be in this market! In the meantime, how do we use this to market to our advantage?

Finding the stocks that will move in sympathy with NVIDIA is an excellent way to ride the momentum. So let’s ride the NVIDIA hype train and look at these 2 stocks that should provide a similar upside with potentially less volatility in a less-crowded trade.

AMD (NASDAQ: AMD)

This may have been an obvious choice but AMD has a lot to offer investors. You might have noticed that AMD didn’t move much following its own earnings report, but jumped by more than 10% after NVIDIA’s. This is exactly what I mean when I say stocks like AMD are riding the NVIDIA hype train. It’s almost as if AMD moves more according to NVIDIA’s performance than its own!

But AMD has a lot of substance to it too. The company’s MI300 chip is widely seen as the top challenger to NVIDIA’s AI chip: the H100. The MI300 is expected to be one of the world’s best data center chips and companies like Microsoft (NASDAQ: MSFT) and Meta Platforms (NASDAQ: META) are already stockpiling them. One advantage the MI300 has is that it is significantly cheaper than the H100. Customers can purchase four of AMD’s chips for every one of NVIDIA’s making it an attractive alternative.

Make no mistake, NVIDIA is the leader in AI chips right now but AMD is rapidly gaining ground. Can AMD dethrone NVIDIA in 2024? Maybe not, but I think the company can steal some market share. If you want to buy a stock that can run just as much or even more than NVIDIA this year, check out AMD.

Taiwan Semiconductor Manufacturing Company (NYSE: TSM)

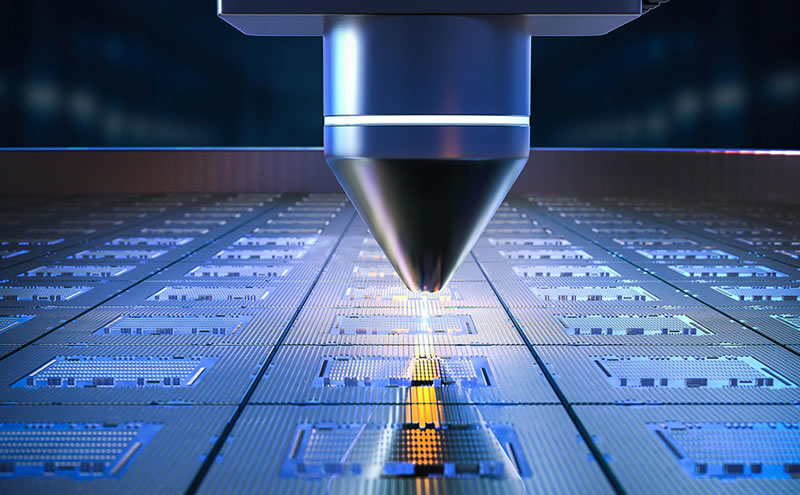

If you want to invest in NVIDIA’s growth, then there might not be a better company than Taiwan Semiconductor Manufacturing Company. Why? Because NVIDIA does not actually make its own chips, TSM does. NVIDIA is a fabless chip designer which means it outsources all of its chip production to TSM. This is fairly common in the industry and is also done by companies like AMD and Apple (NASDAQ: AAPL).

So if NVIDIA is seeing massive demand for its chips, then so is TSM. The stock also trades at a more reasonable valuation with a forward PE ratio of just 20, compared to 34 for NVIDIA. Finally, TSM is expanding its operations to the United States and Japan. This should ease the minds of investors who are concerned about a potential Chinese invasion of Taiwan. TSM also pays out a 1.49% dividend yield and has often been called the most important business in the world. If you’re adding NVIDIA, I would look to add some TSM to your portfolio as well.

Rate this article