The EV (electric vehicle) tax credit is a federal tax credit available to individuals who purchase a new electric vehicle (EV). The tax credit was established as part of the Energy Policy Act of 2005 and was later expanded by the American Recovery and Reinvestment Act of 2009. The tax credit allows individuals to claim a credit of up to $7,500 on their federal tax return for purchasing a new EV.

In recent years, there has been some discussion about the potential delay of the EV tax credit. In December 2019, the U.S. Treasury Department proposed a rule that would have delayed the EV tax credit for certain automakers, including Tesla (NASDAQ: TSLA) and General Motors (NYSE: GM). The proposed rule would have required automakers to sell a certain number of EVs before they could claim the tax credit. The rule was never finalized, and the EV tax credit remains today.

This article will briefly analyze how Tesla and General motors would benefit from the tax delay.

TELSA (NASDAQ: TSLA)

Tesla is a company that designs and manufactures electric vehicles, energy storage systems, and solar panel systems. The company was founded in 2003 by Elon Musk and has become a leader in the electric vehicle industry. Tesla's electric vehicles, such as the Model S, Model 3, Model X, and Model Y, have gained popularity due to their advanced technology and range of capabilities. The company also sells energy storage systems for homes and businesses and solar panel systems for residential and commercial use.

GENERAL MOTORS (NYSE: GM)

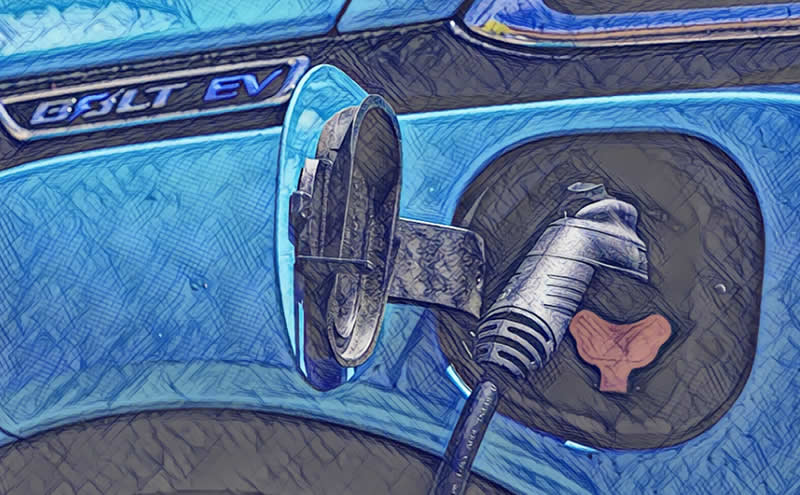

General Motors (GM) is a multinational corporation that designs, manufactures, and sells vehicles and is one of the largest automakers in the world. The company was founded in 1908 and is headquartered in Detroit, Michigan. GM sells various vehicles under various brands, including Chevrolet, Buick, GMC, Cadillac, Holden, and Wuling. The company also has a significant presence in the electric vehicle market, with electric and hybrid models such as the Chevrolet Bolt, Chevrolet Volt, and Cadillac CT6 Plug-In Hybrid.

In addition to vehicles, GM also offers financial services and operates a global supply chain that includes auto parts and components production.

The delay of the Treasury EV tax credit rule could benefit Tesla and general motors in several ways.

Here are a few possible ways that Tesla could benefit from the delay-

Increased demand

The EV tax credit provides a financial incentive for consumers to purchase electric vehicles, so the credit delay could potentially increase demand for Tesla and General motors electric vehicles.

Competitive advantage

If the EV tax credit is delayed, it could give Tesla and general motors a temporary competitive advantage over other manufacturers that have already reached the 200,000 vehicle limit for the credit.

Increased profitability

The EV tax credit can significantly reduce the cost of purchasing an electric vehicle for consumers, so the credit delay could result in higher profitability for Tesla and general motors as the company continues to sell its electric vehicles at total price.

Increased market share

The delay of the EV tax credit could allow Tesla and General motors to capture a larger share of the electric vehicle market, as consumers may be more likely to purchase a Tesla vehicle to take advantage of the credit before it expires.

However, all may not be okay for both companies. The delay of the Treasury EV tax credit rule could also have negative consequences for Tesla and general motors, such as potentially reducing demand for electric vehicles overall if consumers are unable to take advantage of the credit. Additionally, the delay could result in increased competition from other manufacturers that may be able to offer more affordable electric vehicles without the benefit of the tax credit.

Right now, Tesla has seen a recent sell-off in the market. The stock is already down more than 30 per cent this month and could go lower before the end of the year. No matter the good news about Tesla coming to the market, this is the wrong time to own the stock; probably when the time is right.

Rate this article