There is no doubt that there is a new kid in the Wall Street block. The FAANG, MSFT and AMD have found a strong competitor amid the meteoric rise in 2020 of Elon’s only public company. Yet again, during the last 2 weeks Tesla’s stock has behaved like a roller coaster. With the S&P 500 inclusion out of the picture, can Battery Day be the catalyst that takes the stock to new heights?

Battery Day & strong sales as a candle in the dark.

September is a month that has been historically tough for the stocks market. All three major indexes decline in September, DJIA with a 0.8% decline, the S&P 500 a negative 0.5% and NASDAQ another 0.5% decrease. This September in particular has been touch for tech, but even more so for Tesla. The stock has posted a 26.5% declined month to date. Initially, its major international investor decreased its position due to regulations and right after it was hit as the technology sector declined in what it has been its major sell off since June. Additionally, Tesla seemed well positioned to be included on the S&P 500 but concerns about its volatility and market valuation drove the index to add Etsy instead. These 3 factors have cancelled the 12% initial jump they posted after the 5 to 1 stock split in late August.

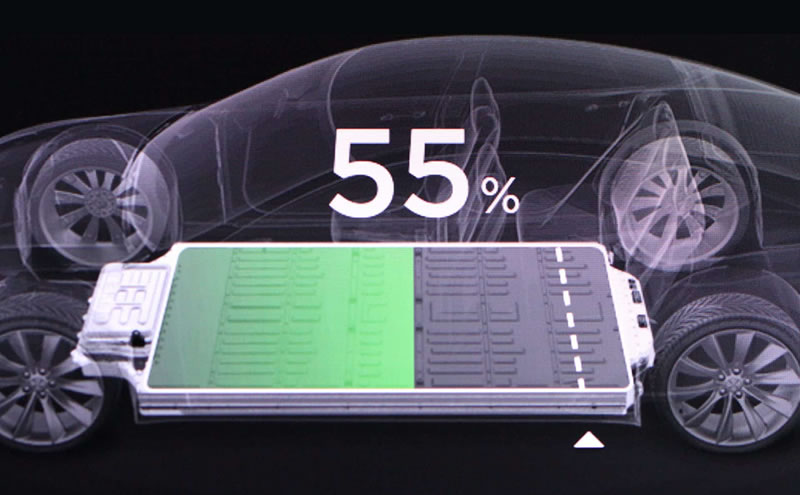

Elon might still surprise us this month, and not precisely with one of his famous tweets but with news about the future of Tesla. Confirmed for Sep. 22nd is the Battery Day event. It is the company’s version of a technological showcase where they present current developments and future projects. Tesla seems to be teasing a couple announcements that would give them an edge over the competition. The first one is a Million Mile Battery that has been in talks after a patent was filled by the company for a single-crystal cathode. Such development would remove the concerns regarding the batteries' life spam and its effect for the environment. Making, at the same time, the cars a lot more attractive.

A second possibility comes from the background image they selected to announce the event. The pictures displays silicon nanowire anodes, a technology that would increase the energy density in batteries from 250 Wh/kg to 400 Wh/kg. To put this in context, the autonomy on the Tesla Model 3 Long Rage would increase from 322 miles to over 500 miles. Fueling these gossips is the fact that a company called Amprius recently moved very close to Tesla headquarters. How is this relevant, well it turns out they are the leading team developing this technology. Furthermore, a recent tweet (8/24/2020) from Elon indicates that the technology is very possible and will be ready in 3 or 4 years from today. This one in particular sounds a lot more possible.

Although these announcement are very hypothetical and far from commercialization we should not underestimate the impact they can have on the stock. Tesla has a cult like investors that have helped the company break every Wall Street rule. To the mix we have to add that they have actually delivered 2 consecutive positive quarters. In Q2, for example, 4 major car makers (Toyota, Ford, Fiat Chrysler and General Motors) posted a 30% decline in sales YoY; Tesla, however, decreased only 5% while delivering 7% more vehicles than expected.

The Model 3 in particular has established itself as the top selling Small/Mid Size Luxury Sedan in US for almost a year now. According to CleanTechnica, in the first half of 2020 the Model accounted for 17% of all sales in the in the US for this category. Also on the same comparison, Tesla with just this model, outsold all combined models from each of the following brands: BMW, Mercedes, Audi, Lexus and Infinity. One more on what it has become the company's flagship: Guess which is the only EV on the list of the Top 20 most sold cars in US in 2020 so far? No need to say the name. This proves that not only there is demand for the All American EVs, but that Tesla is also stealing market share to the big guys.

Conclusion

Tesla has solidified as a company with 2 positive quarters. They have been gaining ground to other auto makers with the Model 3 commanding the fleet. The EV industry should be a winner takes all. They are far better positioned than all competitors to do so. So far Elon is delivering on its mission of accelerating the world transition to sustainable energy. Moreover, despite the many new competitors there is no clear product or company that is even close to Tesla.

Regarding the stock, volatility will be more likely the name of the game during the rest of September. TSLA, because of its very high trading volumes, will continue its roller coaster ride while remaining vigilant of a bearish market. We should do the same and keep an eye on Elon’s twitter account just in case he decides to share more details ahead of Battery Day. The event could act as the jumpstart that takes Tesla to all-time heights. Trade at your own risk but don’t let FOMO drive you, always be informed. Tesla is the new cool kid on the block that eventually will have to play by the Wall Street rules too.

Rate this article