In an unprecedented development, Nvidia (NASDAQ: NVDA) has stormed into the trillion-dollar club, becoming the first chip stock ever to reach this zenith, and marking a landmark moment in the AI revolution. The juggernaut's astounding ascent has been central to the broader market gains this year, with the "Magnificent Seven" – Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOGL), Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Microsoft (NASDAQ: MSFT), Meta (NASDAQ: META), and Tesla (NASDAQ: TSLA)– enjoying gains between 35% and 180%. Nvidia, taking the lead, saw its valuation surge by nearly 50% in May alone.

A Year of Uncertainty

The past year has seen investors juggling myriad concerns, from fears of a looming recession, uncertainty over interest rates from the Federal Reserve, geopolitical tension with Russia, to contentious debt ceiling negotiations in Congress. Amid these unsettling elements, Nvidia's ascendancy has been a beacon, shedding light on potential future trajectories once these uncertainties are put to rest. Yet, a pressing question remains: Will the AI boom be robust enough to insulate the stock market and the broader US economy?

The Force Behind Nvidia's Meteoric Rise

A key factor driving Nvidia's remarkable surge is not merely a record-breaking quarter but a promising forecast of an even stronger future. When OpenAI's ChatGPT was released in November, it caused a seismic shift in the industry. Nvidia has since not only harnessed this momentum but has also quantified its impact. With predictions of $11 billion in sales over the coming quarter, the future indeed looks brighter than the present.

This presents an enormous opportunity and a paradigm shift in how data centers and other sectors are being restructured. Nvidia's (NASDAQ: NVDA) remarkable performance has been underpinned by strong demand to retrofit the world's data centers with advanced, AI-powered architectures, heralding a potential 10-year transition towards accelerated computing.

The AI Revolution and the Stock Market

Despite Nvidia's exceptional performance over the past 12 months, its success has yet to percolate into the broader stock market. While it has paved the way for greater growth, most investments in AI are concentrated in a select group of companies, leading to fears of a stock market comprising a few winners and numerous losers. As a case in point, the S&P 500 and the Dow remained largely unmoved by Nvidia's stellar performance, though it did impact the NASDAQ, where tech stocks are primarily housed.

The Road Ahead

While AI's transformative potential is beyond doubt, the future is fraught with challenges. Companies will have to navigate their way through the technological shift and figure out the best way to harness these technologies. While companies like Nvidia will be winners, fears of an AI price bubble persist. With the current environment not conducive to feeding such bubbles, the emphasis is now on a more measured approach.

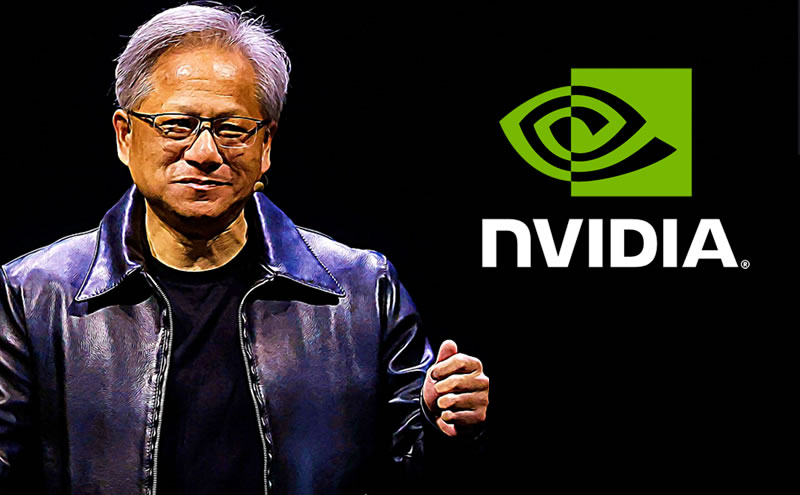

For retail investors, this could translate into grappling with high valuations. While some may view a pullback in tech stocks as a buying opportunity, others may perceive it as a sign of caution. Nvidia's rapid ascension to the trillion-dollar club signifies that the AI boom is more than just a trend – it is the future. As Nvidia CEO Jensen Huang recently advised during a commencement speech, "You're at the beginning, at the starting line of AI. Run. Don't walk."

In the exhilarating race of AI, whether one is running for food or from being food, it seems, is still uncertain. What is certain, however, is that AI – with Nvidia leading the pack – is here to stay, and it's changing the world as we know it.

Rate this article