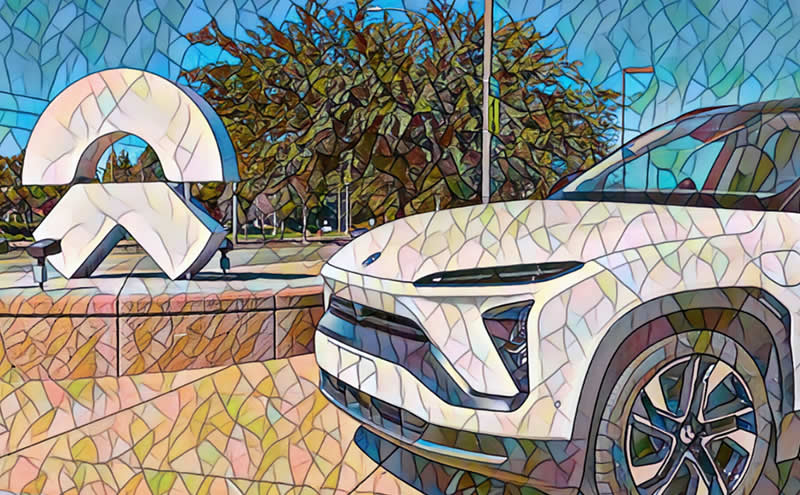

J.P. MORGAN has a long-term bet on Chinese stocks. The global investment firm recently made its first investment in an internet and EV company, NIO (NYSE: NIO), and has also invested in an electric vehicle maker called XPENG (NYSE: XPEV). The next step for the firm is to get more liquidity into the market as it looks for more companies to invest.

Interest in Electric vehicles

J.P Morgan is betting on the electric vehicle market, with one Chinese company already making a name for itself in this space: NIO.

This is a familiar name to investors following China's E.V. market closely over the past few years as it has seen rapid growth. NIO has products ready for launch and plans for more coming through 2022 and 2025.

NIO has been working on its first all-electric SUV since being founded in 2017 by former Uber executive Diarmuid O'Connell and technology entrepreneur William Li. The company aims to build an autonomous driving platform that will enable cars with no driver input, so you don't need a smartphone or key fob - just enter your destination into their app! They previously founded Tencent's gaming division Hunan Broadcasting System (HBS).

NIO's Bullish Case

NIO's bullish case came as a result of the Chinese Government's announcement to start easing its strict Covid-19 guidelines. These strict guidelines affected NIO's production of EVs. They delivered less than expected EVs and missed EPS for Q2 2022. Easing the guidelines would mean the opening of some strategic production sites for NIO, delivering more EVs, and posting better profit margins for the subsequent quarters.

Looking at the delivery report of NIO, there was a decline in October when compared with the previous months. October figures were about 10,000 while September numbers stood at 10,873 vehicles. If the two temporarily shut-down plants do not resume operation, we can expect a further decline in these numbers. No wonder JP Morgan is betting on this Chinese Stock at the moment.

Interestingly, NIO (NYSE: NIO) rallied about 17% during trading hours on Friday, this week. I see more uptrend towards the end of the year.

Another bullish case for NIO is that the delisting worry of Chinese stocks would soon be over following the US auditing of these companies. With the lack of access to financial data from Chinese companies such as NIO, it was difficult for investors to take huge positions in these companies. In fact, there was an impending case of being delisted from the US stock market. This would spell woes for investors and the general outlook of Chinese companies.

But right now, NIO is trending towards a safe zone. Personally, I would look for a perfect entry price to get into NIO. There's support at the $10 zone. A dip in price back there would spell buy for me.

J.P Morgans' Alternative Advise

J.P Morgan is also giving financial advice to look at emerging markets for investors. This is another reason why they're betting on this Chinese stock. JP Morgan's emerging market strategists favor China, Indonesia, Brazil, Russia, Arabia, and Thailand. Specifically, they advise buying mining and cars, raw materials such as iron ore, and regions such as Brazil and the United Kingdom. They conclude by recalling their basket of exposure to emerging markets "has risen 6% annually against the market."

Well, considering the downtrend in the US stock market, I'll also consider looking at quality stocks in emerging markets. In subsequent articles, I'll give a detailed analysis of some of these stocks to hold until we see a prolonged rally in the US stock market again.

Rate this article