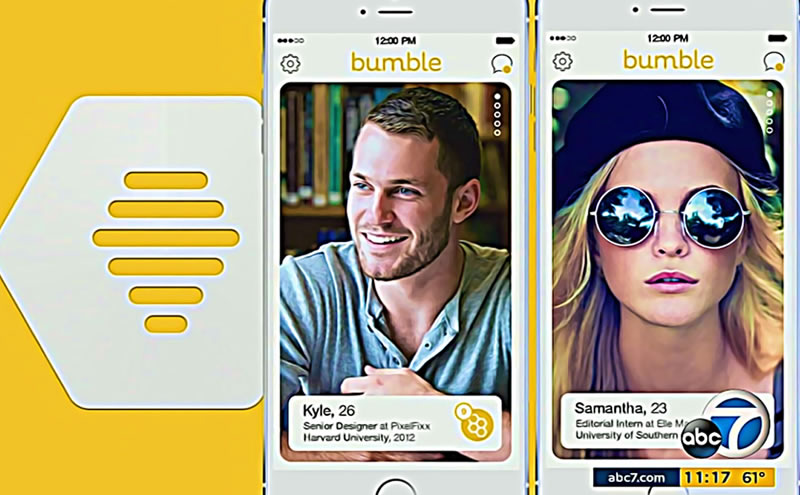

Bumble Inc. is up 45% after the company reported solid fourth-quarter results and got an analyst upgrade. Bumble, a dating app famous for enabling women to make the first move, said it anticipates revenue for the whole year to reach as high as $944 million, compared to analysts' expectations of $939 million.

BMO analyst expects Bumble shares to double

BMO Capital analyst Daniel Salmon raised Bumble from Market Perform to Outperform and kept his price target at $48 on the company, saying online dating is "poised to outperform" the internet industry. His PT represents another 100% increase in the stock price on top of the price action today.

After lagging competitor Tinder owner Match Group (MTCH) in recent months, Salmon believes Bumble is bridging the gap and believes the stock has a 150 percent potential.

Catalysts should be led by the Bumble app and include foreign expansion milestones as well as additional package launches in the near future, according to Salmon. Bumble just acquired France's Fruitz as it seeks to expand its presence in Europe, where it is attempting to catch up to Match.

Before the findings were revealed Tuesday afternoon, the stock had dropped over 50%, reaching an all-time low, as investors were concerned about Bumble's ties with Russia and Ukraine.

Bumble’s response to the war in Ukraine

However, Bumble has announced that it would cease operations in Russia and will remove its applications from the Apple App Store and Google Play Store in Russia and Belarus. The full-year revenue prediction includes a $20 million loss from Russia, Ukraine, and Belarus, which will mostly affect Bumble's Badoo app. The combined sales from the three nations accounted for around 2.8 percent of Bumble's yearly revenue of $765.7 million. Almost all of the income produced in the region came through the Badoo app, according to a statement issued by the firm on Tuesday.

According to Salmon, when COVID progresses from pandemic to endemic status and usage begins to normalise with mobility constraints no longer a problem, online dating will regain popularity. According to the analyst, Bumble's lack of advertising revenue in comparison to the Internet industry is also appealing to investors concerned about a recession looming as a result of the Russia-Ukraine war.

BMO Capital analyst Daniel Salmon said:

“While the Tinder story is a more complex/dynamic one than when we last recommended shares, but it’s also de-risked and remains the undisputed category leader. He added that the value proposition of innovations like virtual currency TinderCoin should also become clearer over the next 12 months.”

The stock that trades at a PE multiple off 16.31 is still down roughly 30% for the year.

Rate this article