Did you know? Semiconductor companies remained among the hottest stocks in the 3rd quarter of 2021. According to the semiconductor industry association (SIA),the shipment of semiconductor products was highest in the 3rd quarter of 2021. According to sobering forecast, this increased demand will remain strong in 2022, increasing the revenue potential of chip manufacturers.

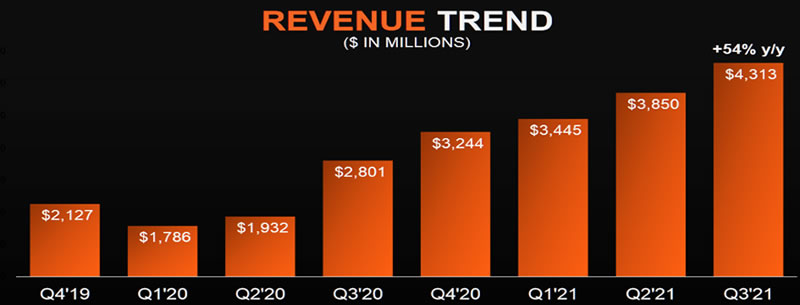

It would be a missed opportunity if you do not include AMD (NASDAQ: AMD) in your portfolio. The stock recorded all-time high revenue of $4.3B, twice compared to the previous year. This significant increase was due to the high demand for Ryzon processors for gamers and creators and 3Rd Gen EPYC for data centers. Big tech giants like Google and Lenovo have invested in the AMD EPYC processor due to its high-performance and security features.

AMD processors, especially,Ryzen have demand from gamers and visual creators. Most users have found Ryzen chips highly compatible with windows 11 and 10. The current release of the Ryzen series, mainly, Ryzen 7 5700 and Ryzen 5 5600 G, has shaken the gaming graphic scene. According to most of the user's experience, the performance of Ryzen Graphic processing Unit (GPU) is twice better than Intel's processors.

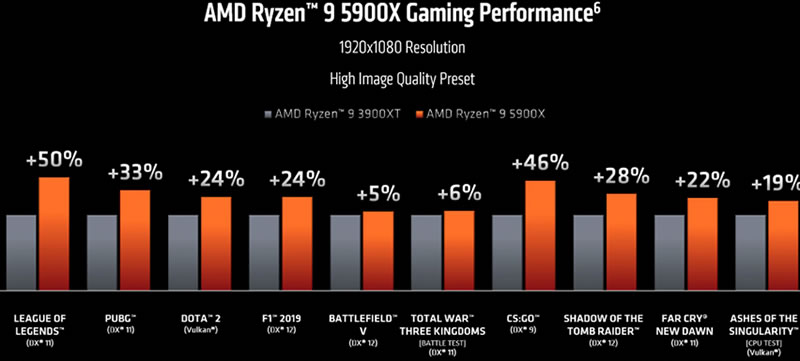

Power-packed gaming performance raised the sales of the Ryzen series in the 3rd financial quarter and became a significant contributor towards the higher Average Selling price (ASP). Typically, the tech industry uses the ASP benchmark: it refers to the price at which a product or service is sold. High demand for Ryzen processors that also supported by Radeon and AMD instinct processors, the computing and Graphics segment revenue was $2.4 billion for the three months; increased by 44% compared to the last year in the same period. Consequently, the boosts in sales increased ASP by 83% in the third quarter.

The second most demanding product is EPYC 3rd generation processor. EPYC is the world's highest-performing x86 server CPU. With an increasing number of xs86: 32-bits, this processor can perform any instruction more quickly and efficiently. Increased adaption of EPYC powered by mega-corporate companies like Argonne National Labs and Google were the third quarter's highlights. That kind of competitive edge from EPYC processors resulted in $1.9 billion in revenue in the second segment of the company. Enterprise, embedded, and semi-custom segments (EESC) increased 69% YoY and 20% QoQ featured by EMPYC processor and semi-custom product sales. According to financial reports of the third accounting session, the total nine-month revenue generated by the EESC was $4860M that was more than twice the previous year's nine-month revenue that estimated at $2047M.

Source: AMD investor guide

While the semiconductor industry is showing tremendous output, AMD continues to explore with innovative products and acquisitions. It will be a waste if investors ignore chip makers' stocks until 2022, especially AMD. That remained one of the best-performing stocks in 2021 and one of the favorites among investors. Based on the current revenue trajectory and an expected hike in semiconductor stock, it is a BIG YES to BUY!

Rate this article