By now, you must have realized that geopolitical events have profound effects on the stock markets. Last week, the Russian invasion of Ukraine showed us how fear could be a driver for negativity in the markets. The surging inflation and the possibility of interest rate hikes were added to that. During times of unrest, many persons hoard cash and put their money into safe-haven assets like bonds.

Another strategy shift among discerning investors is to invest in defense stocks. With the Russian-Ukraine war in the background, the three defense stocks in this article are good buys during times of conflict.

1. General Dynamics Corp. (NYSE: GD)

General Dynamics Corp is a diversified and fundamentally strong stock in the defense sector. It has a leading market position in marine systems, combat systems, and mission-critical technologies. It also has its hands' in the business sectors where it manufactures and operates aircraft services and aviation products.

In its Q4 and Full-year report for 2021, the stock has net earnings of $952 million, beating estimates, with $10.3 billion in revenue. Its Earnings-per-share stood at $3.39. Most revenues for the company were in the aerospace division. It had a $16.3 backlog of earnings in this division, representing a growth of 40% year-over-year. The marine business also saw notable revenue growth. Management believes that this positive trend will continue because of the demand for more jets from government and business customers, along with the increasing demand for combat ships and nuclear-powered submarines.

This investment is very attractive because the company is very shareholder-friendly. For the last 31 years, the company has been increasing its dividends paid to shareholders every year. Last quarter, it was raised by 8%. The stock currently stands at $227.98 and has grown 4% at the start of this week.

2. L3Harris Technologies Inc (NYSE: LHX)

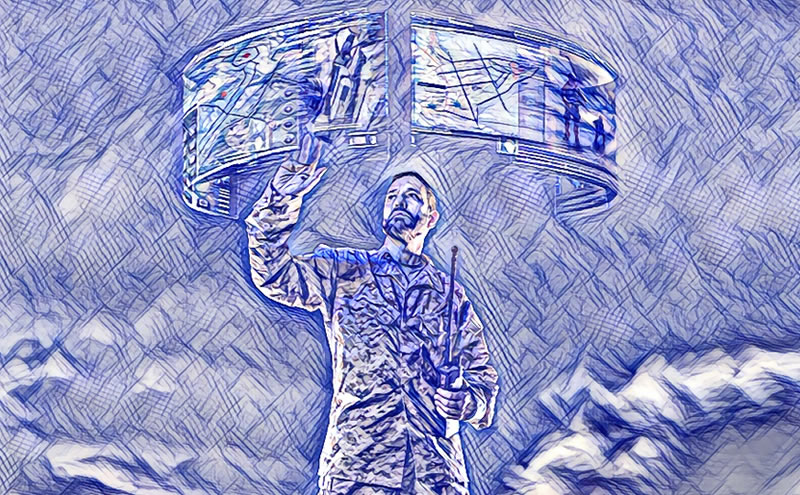

L3Harris Technologies Inc doesn’t own a plant that manufactures heavy artillery used in war, but both governments and private firms use its communication equipment as a component of fighting wars.

At a time when the U.S company is evaluating mission-critical electronics systems for the defense industry, L3Harris Technologies stands a good chance of benefiting greatly. In addition, the company has notable companies in its clientele, such as Boeing and Lockheed Martin, who are the White House's leading contractors. Therefore, L3harris Technologies has a unique back-door to the power center that places it at a vantage point.

At the beginning of this month, the company published its Q4 and Full-year earnings report for 2021which beats estimates. It delivered 5% of year-over-year growth in profits. This was primarily due to an increase in U.S military spending, and with the spate of conflicts around the world, this trend is expected to continue.

The company raised its dividend by 20%. The company has been increasing its dividend for the past 21 years. It had a payout ratio of 28%, and dividend growth is foreseen in the future. The stock is currently at $233.51, with a further rise expected.

3. Raytheon Technologies Corp. (NYSE: RTX)

Although Raytheon Technologies is a leader in the defense and aerospace markets, recently, it has evolved into a jack-of-all-trades. Its diversification stems from its 2020 merger with United Technologies, including Pratt & Whitney and Collins Aerospace.

The stock has had several successes for years that propelled it into the Dow-30 category. That success has not relented. Its’ recent Q4 adjusted earnings showed a 40% surge in profits, especially from the United Technologies side of the business. However, the core business, handled by Raytheon, has recently seen a slump due to some underperforming segments and a slump in international orders.

Overall, there has been growth for the company. Management has forecasted that the increase will be coupled with renewed margins and operating efficiency gains.

The stock, which is trading at $101.94, experienced a 3% growth when going to press.

Rate this article